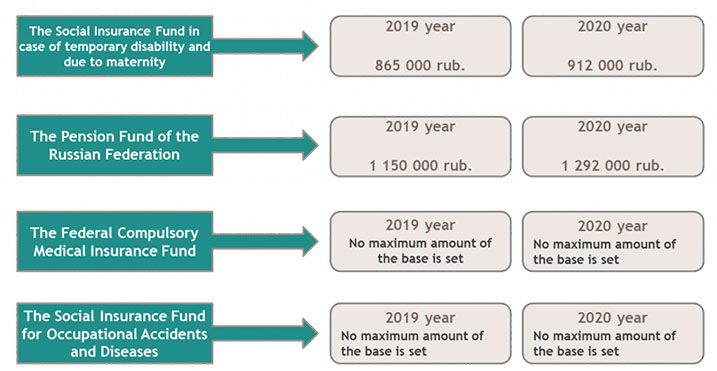

MAXIMUM AMOUNT OF THE BASIS FOR INSURANCE PREMIUMS

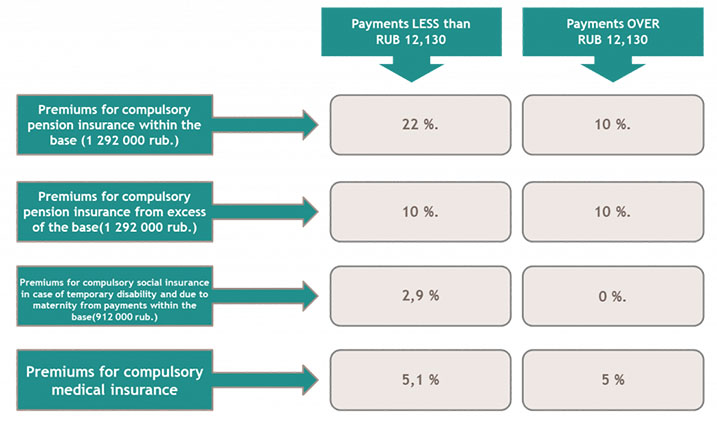

RATES OF SOCIAL INSURANCE PREMIUMS

The former rates of insurance premiums are approved for the main categories of payers of insurance premiums:

-

the Pension Fund of the Russian Federation — 22% (10% above the maximum amount of the base),

-

the Federal Compulsory Medical Insurance Fund — 5.1%,

-

the Social Insurance Fund — 2.9% (1.8% of the remuneration to foreign citizens temporarily residing in Russia).

Decree No. 1407 of the Government of the Russian Federation dated 06 November 2019 «On the Maximum Amount of the Base for Insurance Premiums for Compulsory Social Insurance in Case of Temporary Disability and due to Maternity and for Compulsory Pension Insurance from 01 January 2020»

REDUCED RATE OF INSURANCE PREMIUMS FOR SME

From 01 April 2020, the insurers (companies and entrepreneurs) that are included in the register of small and medium enterprises, have the right to calculate premiums at the reduced rate of 15% (the reduced rate applies only to the payments made to an employee that exceed federal MW of RUB 12,130).

If income is equal to or less than MW, the general rate of 30 percent is applied (22% – pension insurance, 5.1% – medical insurance, 2.9% – social insurance).

If the total amount of payments made from the beginning of the year exceeds the maximum amount of the base for premiums, then pension insurance premiums are accrued from such excess at the rate of 10%.

The premiums shall be calculated from the base for each month, and not as a cumulative total from the beginning of the year.

Companies with part-time employees are not entitled to apply the reduced rate of premiums.

Refer to the section «Uniform Register of Small and Medium Enterprises» on the website of the Federal Tax Service to verify whether the company is included in the SME register.

Federal Law No. 102-FZ dated 01 April 2020

Letter No. BS-4-11/5850@ of the Federal Tax Service of Russia dated 07 April 2020

Download the leaflet