Our experts have examined and given their comments on the key changes in such fields of taxation as VAT, income tax, transport, land and agricultural taxes, using of the simplified tax system, controlled transactions with residents and non-residents, specific taxation of innovative companies, payment of state duties, and specification of tax payments.

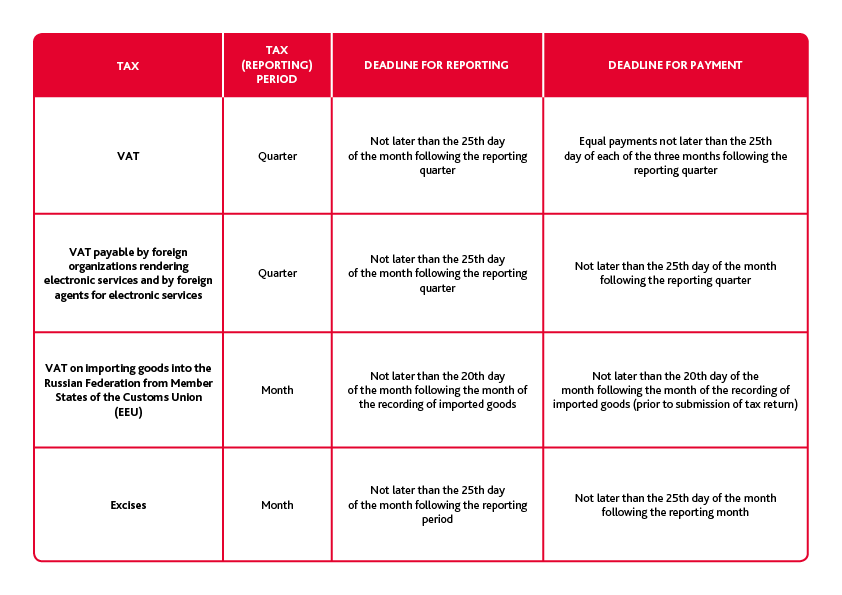

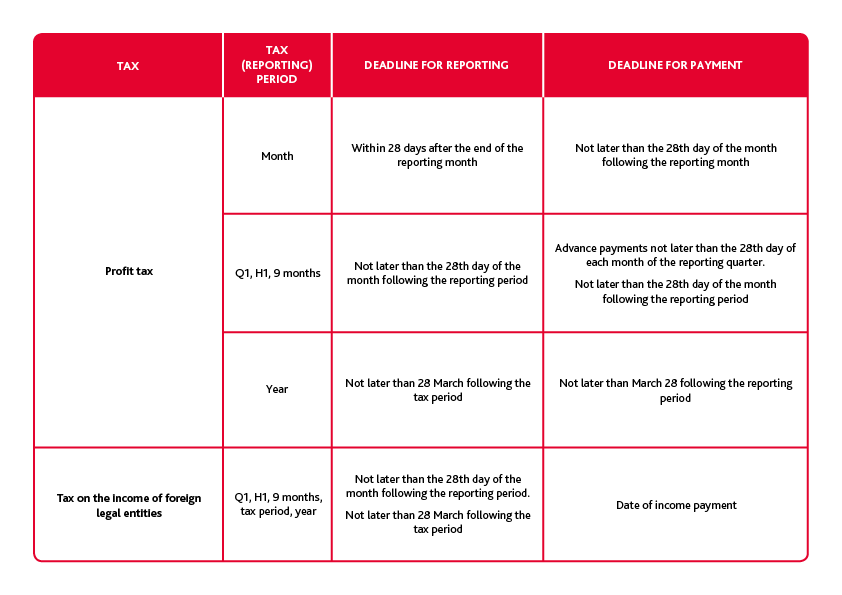

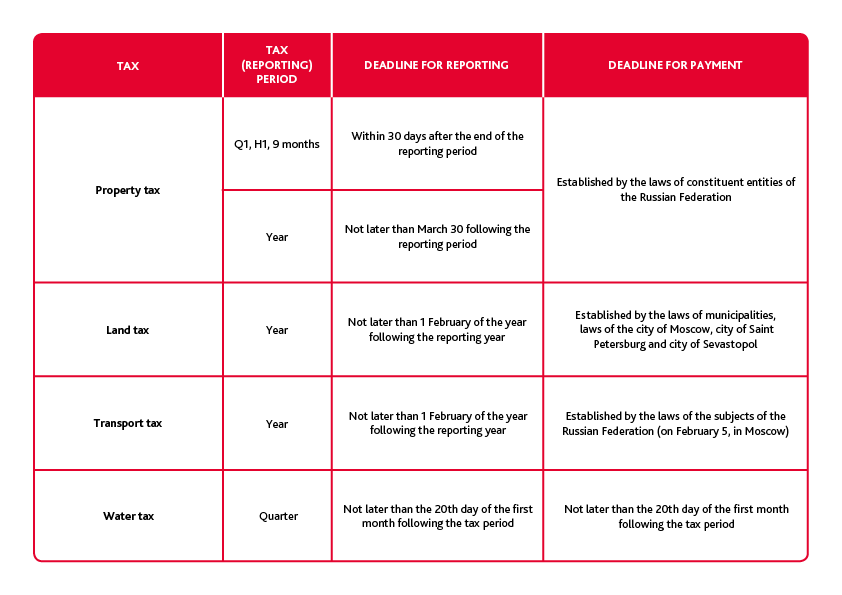

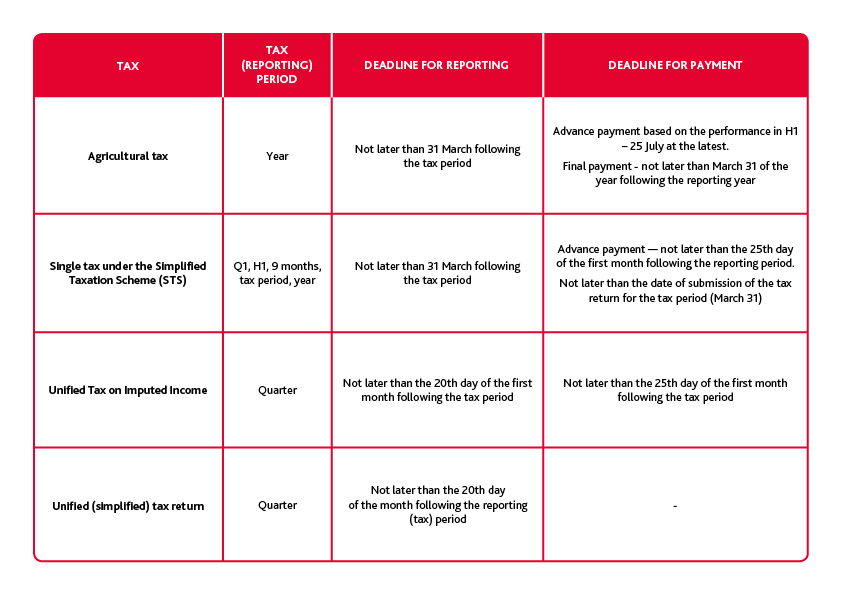

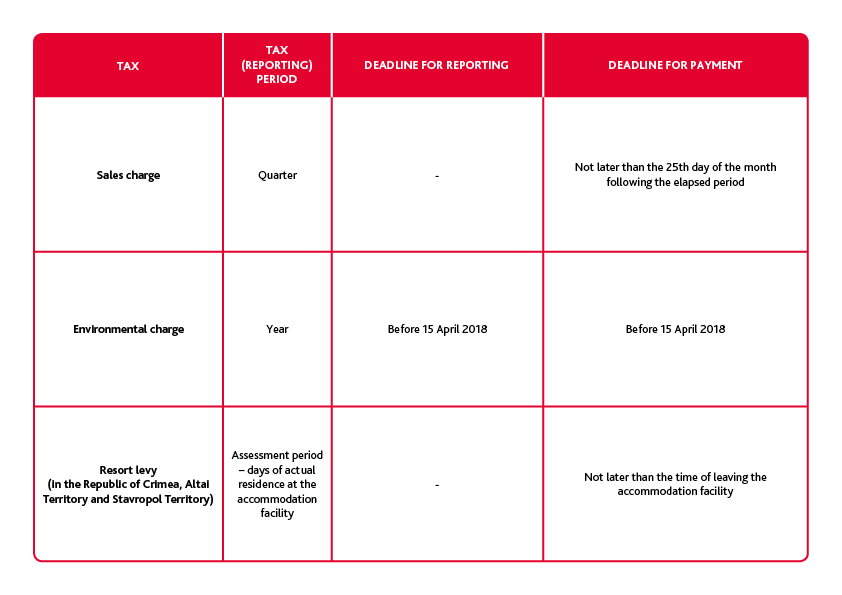

Here you can find the list of taxes and charges and deadlines for reporting and payments in 2019.

Please enjoy the study and remember that BDO Unicon Outsourcing specialists are always eager to help you understand the specifics of the new requirements of the Federal Tax Service.

Поделиться:

- Telegram

- ВКонтакте

Subscribe to our publications

We write only about the most important. You will be the first to know about economic events that affect your business, how to reduce costs, optimize the company's operations and make the right management decisions without immersion in operational processes.

Subscribed