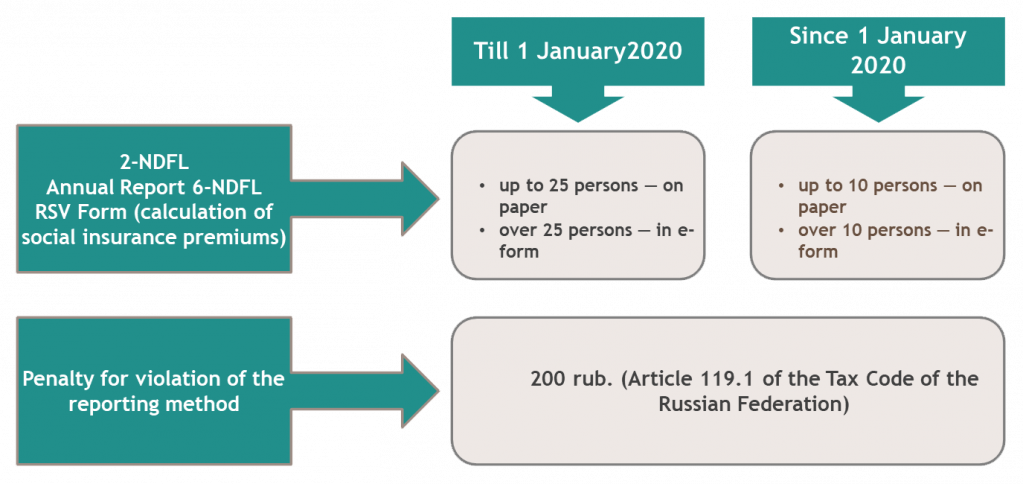

NEW FILING PROCEDURE FOR 6-NDFL AND 2-NDFL FORMS

Federal Law No. 325-FZ dated 29 September 2019

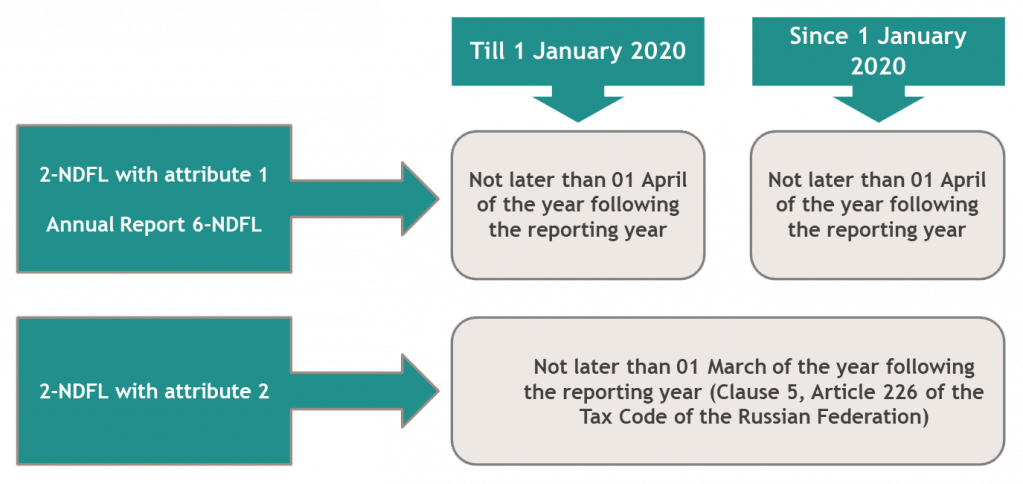

NEW DEADLINES FOR 6-NDFL and 2-NDFL FILING

Federal Law No. 325-FZ dated 29 September 2019

NOTICES FOR RECOGNITION OF PERSONAL INCOME TAX PAYMENT DATES IN 6-NDFL IN CONNECTION WITH NON-WORKING DAYS

For companies (except for those specified in Clause 2 of Edict No. 206, Clause 4 of Decree No. 239, and Clause 3 of Edict No. 294), the deadline for payment of the personal income tax withheld in the period from 30 March 2020 through 8 May 2020 is transferred to 12 May 2020.

6-NDFL Form shall contain the date 12 May 2020 in line 120 «Tax Payment Deadline»

Letter of the Federal Tax Service of Russia No. BS-4-11/7791@ dated 13 May 2020

NEW RULES FOR FILING THE PERSONAL INCOME TAX REPORTING AND PAYING THE PERSONAL INCOME TAX FOR COMPANIES HAVING SEPARATE SUBDIVISIONS (SS)

From 01 January 2020, if the headquarters and separate subdivisions are located within the same municipal entity; or all separate subdivisions are located on the territory of the same municipal entity, then:

-

personal income tax statements shall be filed and the tax shall be paid to the Federal Tax Service Inspectorate located at the place of registration of one of the separate subdivisions (or headquarters), which the company has chosen independently by notifying the Federal Tax Service Inspectorate thereof;

-

it is not allowed to change the personal income tax filing and payment procedure within the tax period;

-

the form of notice is approved by Order No. MMV-7-11/622@ of the Federal Tax Service of Russia dated 6 December 2019 «On Approving the Form of Notice about the Selected Tax Authority, its Filling Procedure and E-Filing of the Notice to the Selected Tax Authority».

Federal Law No. 325-FZ dated 29 September 2019

PERSONAL INCOME TAX REPORTING IF THE HEADQUARTERS AND THE SEPARATE SUBDIVISION ARE LOCATED IN THE SAME MUNICIPAL ENTITY

If a company has a separate subdivision within the same municipal entity as the headquarters and the company has timely notified the Federal Tax Service Inspectorate that the headquarters will report for the separate subdivision in 2020, then the reporting shall be made as follows:

-

in 2020, the parent company shall file the calculation under 6-NDFL Form for the periods of 2020 and data under 2-NDFL Form for 2020 centrally at the place of its registration, for itself and for its separate subdivision;

-

The personal income tax statements for 2019 shall be filed in accordance with the previous rules: separately for the parent company and its separate subdivision — at the place of registration of each of them.

Letter No. BS-4-11/7971@ of the Federal Tax Service of Russia dated 14 May 2020

NEW 3-NDFL FORM FOR 2019

The new form includes the amendments introduced to:

-

Appendix 2 reflecting income from sources outside the Russian Federation;

-

Appendix 5 with calculations of standard, social, and investment deductions;

-

Appendix 7 with the calculation of property deductions for the costs of housing purchase.

Order of the No. ММV-7-11/506@ Federal Tax Service dated 07 October 2019

NEW FORM OF INSURANCE PREMIUM CALCULATION (RSV) APPLICABLE FROM 1 QUARTER 2020

Additional boxes for information about a separate subdivision that has been deprived of authority (closed) has been introduced on the front page.

A new line ‘Payer type (code)’ is introduced into Section 1 «Consolidated data on liabilities of the insurance premium payer», which shall include:

1 — if payments were made to individuals during the last three months of the calculation period

2 — if no payments were made.

The following amendments have been introduced into Section 3 «Identifying information on insured persons»:

-

the «Calculation (reporting) period (code)» and «Calendar year» boxes have been removed (this information is on the front page);

-

«Indication of cancellation of the information about the insured person» box has been is added. It shall be filled in the updated RSV Form only: when canceling the information previously filed with regard to an individual or when correcting data about the recipient of income in lines 020-060. In this case, code 1 shall be indicated in the box.

The lines with the total amounts to be paid for the calculation period are also removed from the report.

Order No. ММV-7-11/470@ dated 18 September 2019

NEW CODES FOR RSV FORM FOR THE FIRST SIX MONTHS OF 2020

From 01 April 2020, small and medium enterprises (SMEs) shall calculate premiums at the reduced rate of 15 % based on the part of the monthly salary of an employee that exceeds federal MW.

In this regard, the Federal Tax Service recommends using code «20» until the list of rate codes for the payer of insurance premiums is officially approved.

Subsection 3.2.1 of Section 3 of the Form «The insured person’s category codes» shall be filled in as follows:

-

«MS» for employees for whom the SME shall calculate premiums based on the part of payments and remunerations that exceeds MW;

-

«VZhMS» for foreign citizens or stateless persons who are temporarily residing in the Russian Federation (as well as foreigners or stateless persons who are temporarily staying in the Russian Federation, if they have been granted temporary asylum) registered under the compulsory pension insurance program for whom the SME shall calculate premiums based on the part of payments and remunerations that exceeds MW;

-

«VPMS» for foreign citizens or stateless persons (except highly qualified specialists) for whom the SME shall calculate premiums based on the part of payments and remunerations that exceeds MW.

Letter No. BS-4-11/5850@ of the Federal Tax Service of Russia dated 07 April 2020 «On Reduced Rates of Insurance Premiums for Payers of Insurance Premiums Recognized by Small or Medium-Sized Enterprises»

Download the leaflet