CLARIFICATIONS BY THE MINISTRY OF FINANCE OF RUSSIA OF THE PROCEDURE FOR APPLICATION OF AMENDMENTS IN STATUTORY DOCUMENTS ON BOOKKEEPING

1. Information Message No. IS-uchet-21 of the Ministry of Finance of Russia dd. 25 December 2019 ‘New in Accounting Laws: Facts and Comments’.

IS-uchet-21 clarifies the procedure for submitting accounting statements and the auditor’s report thereon to tax authorities in order to form the State Information Resource of Accounting (Financial) Statements (hereinafter, GIRBO).

Accounting statements submitted as XML files and the auditor’s report thereon submitted as an electronic document in PDF format shall be signed with an enhanced encrypted and certified digital signature and shall be submitted to the tax authority through telecommunication channels via the electronic document management operator.

Upon receipt of the electronic package of documents, the tax authority shall send an acceptance receipt to the company within one business day.

The tax authority may refuse to accept the accounting statements of the company and the auditor’s report thereon, if they are submitted:

-

in any formats differing from the ones approved by the Federal Tax Service of Russia;

-

without an enhanced encrypted and certified digital signature;

-

to a tax authority which is not competent to accept them.

In this case, the tax authority shall send a notice of refusal to accept the documents, and the company, upon receipt of such notice, shall correct the mistakes specified therein and send documents to the tax authority repeatedly.

2. Information Message No. IS-uchet-22 of the Ministry of Finance of Russia dd. 30 January 2020 ‘New in Accounting Laws: Facts and Comments’.

Law ‘On Accounting’ (Clause 4, Article 18) releases certain companies of the obligation to submit a mandatory copy of the accounting statements, in particular, such cases may be established by the RF Government.

On 1 February 2020, Decree No. 35 of the RF Government dd. 22 January 2020 entered into force, cancelling the presentation of a mandatory copy of accounting statements for the purpose of GIRBO formation by the companies included in the list of residents against which a foreign state, a state association and/or union and/or a state (interstate) institution of a foreign state or a state association and/or union has introduced restrictive measures.

The list shall be approved in accordance with Part 4.2, Article 19 of Federal Law ‘On Foreign Currency Regulation and Control’.

(!) Cancellation of mandatory presentation of a copy of the accounting statements for the purpose of GIRBO formation does not release of the obligation to submit one copy of the annual accounting (financial) statements:

-

to the state statistics body at the place of state registration of the company (Clause 7 Article 18 of Law No. 402-FZ);

-

to the tax authority at the place of location of the company (Subclause 5.1, Clause 1, Article 23 of the Tax Code of the Russian Federation).

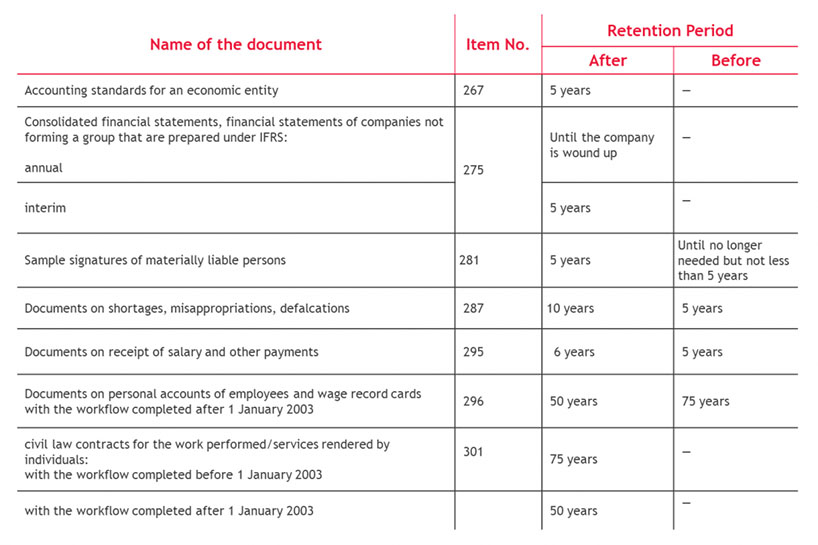

3. Information Message No. IS-uchet-23 of the Ministry of Finance of Russia dd. 26 February 2020 ‘On Updating the List of Archival Accounting Documents and Amending the Rules for Preparing the Federal Accounting Standards Development Program’.

The list:

-

establishes the retention period for standard administrative archival documents issued during the companies’ activities;

-

includes the types of documents generated when documenting the uniform management functions performed by the companies.

Section 2 of Order No. 237 of the Federal Archival Agency dd. 20 December 2019

Order No. 236 of the Federal Archival Agency dated 20 December 2019 ‘On Approval of the List of Standard Administrative Archival Documents Generated during Activities of Central and Local Governments and Entities, with Their Retention Periods Specified’ (hereinafter, the List).

The key changes in the List related to retention periods for a number of documents, including accounting documents:

It should be noted that forms (albums of forms) of unified accounting source documents and registers have been removed from the List. This change is due to the fact that the forms of source accounting documents contained in the albums of unified forms of source accounting documents ceased to be mandatory on the effective date of the Law ‘On Accounting’ (PZ-10/2012). According to Clause 4, Article 9 of Law No. 402-FZ, the source accounting documents of a company shall be drafted as per the forms approved by the head of the economic entity.

Proceeding from the new List, the forms of source accounting documents approved by the company correspond to item No. 267 and shall be retained for at least 5 years.

Besides, the structure of Section 4 of the List, Accounting and Reporting, was changed, and the terminology was adjusted.

The Ministry of Finance of Russia reminded, in its Information Message IS-uchet-22, of the changes in the Rules for Preparing the Federal Accounting Standards Development Program (hereinafter, the ‘Rules’). The new wording of the Rules provides for the following:

-

the Federal Accounting Standards (FAS) development program shall be prepared for 5 calendar years (previously, for 3 calendar years);

-

the FAS development program shall be updated when necessary (previously, on an annual basis);

-

proposals to be included in the draft FAS development program shall be submitted to the Ministry of Finance of Russia on or before 1 July of the year preceding the five-year period (previously, on or before 1 November). Furthermore, proposals submitted to the Ministry of Finance of Russia for inclusion in the draft program may deal not only with the drafting of new FAS, as it used to be earlier, but also with the amendment or invalidation of federal standards.

4. Information Message No. IS-uchet-27 of the Ministry of Finance of Russia dd. 10 April 2020 ‘New in Accounting Laws: Facts and Comments’.

Information Message No. IS-uchet-27 is related to FAS 5/2019 ‘Inventories’, a new Federal Accounting Standard approved by Order No. 180n of the Ministry of Finance of Russia dd. 15 November 2019 (hereinafter, FAS 5/2019).

In its Information Message, the Ministry of Finance of Russia set out the main novelties implied by FAS 5/2019, in particular:

-

definition of inventories is formulated;

-

the scope of application of the standard is adjusted;

-

conditions for recognition of inventories in the bookkeeping are established;

-

it is allowed to change stock-keeping units subsequently (after recognition in the bookkeeping);

-

the general approach towards measurement of costs included in the actual net cost of inventories is established;

-

the procedure for measuring the actual net cost of inventories is changed, including the inventories: purchased on conditions of payment deferral (installment plan); under contracts that provide for payment with non-cash funds; received gratuitously; left after disposal of non-current assets or recovered during the routine maintenance, repair, upgrading, reconstruction of non-current assets;

-

the general rules for formation of the actual net cost of construction in progress are established;

-

valuation methods for in-house agricultural, forest, and fish industry products and goods sold through on-exchange trading are provided;

-

the procedure for inventory valuation after recognition is changed;

-

the procedure for recovery of the inventory impairment provision is changed;

-

the cases of writing-off inventories are adjusted;

-

requirements to disclosure of information about inventories in the company’s accounting statements are adjusted.

FAS 5/2019 provides for a number of simplified methods of accounting for inventories for the companies entitled to use these methods, in particular: in respect of the net cost of purchased inventories, inventories value measurement, recognition of costs for the acquisition of inventories intended for administrative needs.

Besides, micro-companies became entitled not to apply FAS 5/2019. In this case, the costs for the acquisition of inventories are recognized as expenses of the period in which they were incurred.

CONSOLIDATED FINANCIAL STATEMENTS

The conditions caused by the coronavirus infection, measures taken to prevent its spreading, a tough economic situation, and the economy support measures taken by the state have affected, to a certain extent, the business life of the company and the information disclosed in its consolidated financial statements. Due to the existing conditions, the Ministry of Finance of Russia issued the document ‘Certain Issues of Compiling Consolidated Financial Statements of Companies Associated with Their Business Activities in 2020’ (hereinafter, the ‘Document’).

The Document contains a list of items for compiling consolidated financial statements in 2020 and for 2020:

-

business continuity;

-

financial instruments;

-

impairment of non-financial assets;

-

lease;

-

income taxes;

-

liabilities under onerous contracts.

Implementation of particular items depends on the specific facts and circumstances of activities of the company compiling the consolidated financial statements.

It should be noted that the list of items covered by the Document is not exhaustive.

GIRBO

Resolution No. 35 of the RF Government dd. 22 January 2020 ‘On Releasing Companies of Submitting a Mandatory Copy of Accounting (Financial) Statements to the State Information Resource of Accounting (Financial) Statements.

Information of the Federal Tax Service of Russia: “Accounting statements are now available online.”

ACCOUNTING STATEMENTS

Letter No. 07-01-10/49520 of the Ministry of Finance of Russia dd. 09 June 2020 ‘On Compiling Corporate Accounting Statements upon Reorganization through Reconstruction’.

Letter No. 07-01-09/39550 of the Ministry of Finance of Russia dd. 15 May 2020 ‘On Compiling Accounting Statements upon Revealing any Insufficiency of Data for the Formation of a Comprehensive Idea of Financial Position and Financial Performance Results’.

Letter No. 03-02-08/1211 of the Ministry of Finance of Russia dd. 15 January 2020 ‘On the Possibility to Assign Taxpayer’s Obligations to a Third Party, Including under a Contract, and on the Proposal to Change the ‘Bookkeeping’ and ‘Tax Accounting’ Terms’.

Letter No. 07-01-10/65692 of the Ministry of Finance of Russia dd. 27 August 2019 ‘On Filling Out the ‘Accounting Statements Are Subject to Mandatory Audit’ Line in the Balance Sheet Header Section’.

STOCK-TAKING

Letter No. 07-01-09/73 of the Ministry of Finance of Russia dd. 09 January 2020 ‘On Application of the Modern Tools for Revealing Available Property during the Stock-Taking of Company’s Assets and Liabilities’.

Letter No. 07-01-09/102353 of the Ministry of Finance of Russia dd. 27 December 2019 ‘On Statutory Acts Applicable in Stock-Taking in Retail Organizations, and Accounting for Shortage (Deterioration) Loss for the Purpose of Income Tax’.

PBU 1/2008 ‘ACCOUNTING POLICY OF A COMPANY’

Letter No. 07-01-09/2588 of the Ministry of Finance of Russia dd. 20 January 2020 ‘On Formation of the Accounting Policy by a Company Disclosing Consolidated Financial Statements Compiled under IFRS or Financial Statements of a Company Not Creating a Group’.

Letter No. 07-01-09/1633 of the Ministry of Finance of Russia dd. 16 January 2020 ‘On Formation of Corporate Accounting Statements if Items Accounting under Accounting Standards Leads to Misrepresentation of Data in the Statements’.

PBU 6/01 ‘ACCOUNTING FOR FIXED ASSETS’

Letter No. 07-01-07/43949 of the Ministry of Finance of Russia dd. 26 May 2020 ‘On Entering Assets into the Books as Fixed Assets and on Application of the ‘Fixed Production Assets’ Term’.

Letter No. 07-01-09/3835 of the Ministry of Finance of Russia dd. 23 January 2020 ‘On Recognizing, in the Accounting Books and Statements, of Fixed Assets Intended Solely for Provision in Temporary Paid Possession and Use and in Temporary Use for the Purpose of Income Earning’.

Letter No. 07-01-09/2580 of the Ministry of Finance of Russia dd. 20 January 2020 ‘On Recognizing, in the Accounting Books, the Increase in Value of Fixed Assets upon Their Disposal’.

Letter No. 03-03-06/1/42843 of the Ministry of Finance of Russia dd. 22 May 2020 ‘On Entering Catalytic Agents into the Books, as well as on Accounting and Writing Off of Precious Metals Contained Therein’.

Letter No. 03-05-05-01/97667 of the Ministry of Finance of Russia dd. 13 December 2019 ‘On Corporate Property Tax on Real Estate Held for Sale, and on Real Estate Taxed at Cadastral Value from 01 January 2020’.

PBU 16/02 ‘INFORMATION ON DISCONTINUING ACTIVITIES’

Letter No. 03-05-05-01/3316 of the Ministry of Finance of Russia dd. 22 January 2020 ‘On Corporate Property Tax on Long-Term Assets Held for Sale, Including upon Their Conversion to Fixed Assets’.

Letter No. 03-05-05-01/102022 of the Ministry of Finance of Russia dd. 26 December 2019 ‘On Corporate Property Tax on Real Estate Being Long-Term Assets Held for Sale, Including upon Their Conversion to Fixed Assets’.

FAS 25/2018 ‘ACCOUNTING FOR LEASE’

Letter No. 03-05-05-01/102068 of the Ministry of Finance of Russia dd. 26 December 2019 ‘On Corporate Property Tax on the Asset Accounted for as an Item of Non-Operational (Financial) Lease’.

Letter No. 03-05-05-01/97674 of the Ministry of Finance of Russia dd. 13 December 2019 ‘On Accounting for and Corporate Property Tax on Leasing of Immovable Property’.

Letter No. 03-05-04-01/2993 of the Ministry of Finance of Russia dd. 21 January 2020, Letter No. BS-4-21/926 of the Federal Tax Service of Russia dd. 23 January 2020 ‘On Property Taxation with Corporate Property Tax due to Application of FAS 25/2018 ‘Accounting for Lease’’.

PBU 14/2007 ‘ACCOUNTING FOR INTANGIBLE ASSETS’

Letter No. 07-01-10/101011 of the Ministry of Finance of Russia dd. 24 December 2019 ‘On Identifying an Inventory Item of Intangible Assets for the Purpose of Accounting’.

SOURCE DOCUMENTS

Letter No. 03-03-07/38785 of the Ministry of Finance of Russia dd. 13 May 2020 ‘On Using Scanned Copies of Source Accounting Documents in Accounting; on Accounting for Costs for the Purpose of Income Tax’.

Letter No. 03-03-06/38724 of the Ministry of Finance of Russia dd. 13 May 2020 ‘On Issuance of Source Accounting Documents in Electronic Format for the Purpose of Income Tax and Accounting’.

Letter No. 03-03-07/9888 of the Ministry of Finance of Russia dd. 13 February 2020 ‘On Certifying Costs with the Documents Issued in Electronic Format for the Purpose of Income Tax and Accounting’.

Letter No. 03-03-06/1/9882 of the Ministry of Finance of Russia dd. 13 February 2020 ‘On Certifying Costs with the Documents Received via E-mail or by Fax as Scanned Copies or Photo Copies of Original Documents for the Purpose of Income Tax and Accounting’.

OTHER BOOKKEEPING AND ACCOUNTING ISSUES

Letter No. 07-01-10/51101 of the Ministry of Finance of Russia dd. 11 June 2020 ‘On Application of Methods to Calculate Net Income for a Reporting Period and on Recognition, in the Equity Change Statement, of Results of Changes in the Accounting Policy’.

Letter No. 07-01-09/23660 of the Ministry of Finance of Russia dd. 26 March 2020 ‘On Recognition of Company’s Costs in the Books as Assets or Expenses’.

Letter No. 07-01-09/22675 of the Ministry of Finance of Russia dd. 24 March 2020 ‘On Recognition of Loan Expenses in the Books’.

Letter No. 07-01-10/8583 of the Ministry of Finance of Russia dd. 10 February 2020 ‘On Corporate Bookkeeping’.

Letter No. 03-03-06/1/5212 of the Ministry of Finance of Russia dd. 29 January 2020 ‘On Accounting for Costs for Preparation and Development of New Production Facilities, Shops, and Assembly Units for the Purpose of Income Tax and on Recognition of Costs Relating to Future Reporting Periods in the Balance Sheet’.

Letter No. 02-06-10/33871 of the Ministry of Finance of Russia dd. 24 April 2020 ‘On Application of Order No. 157n of the Ministry of Finance of Russia dd. 01 December 2010 by Limited Liability Companies in Bookkeeping’.

ACCOUNTING IN STATE UNITARY ENTERPRISES

Letter No. 07-01-09/402 of the Ministry of Finance of Russia dd. 13 January 2020 ‘On Disclosing Information by Unitary Enterprises on the Property Received in Operational Management’.