CHANGES IN MW AND WELFARES PAID BY THE SOCIAL INSURANCE FUND (SIF)

-

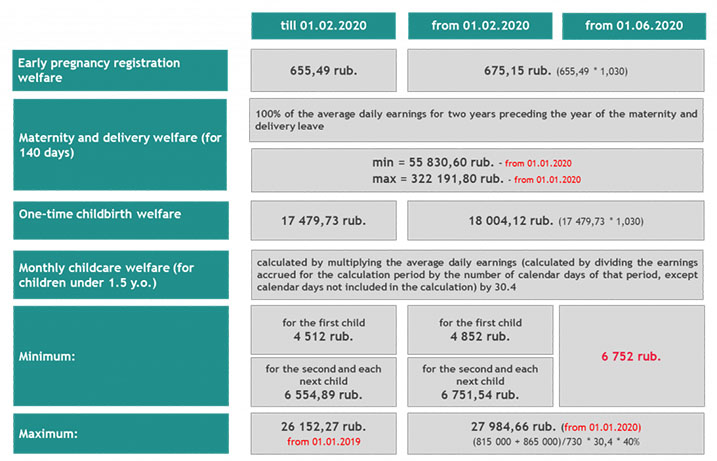

Starting 01 January 2020, MW has increased from RUB 11,280 to RUB 12,130 for the able-bodied population.

-

The indexation rate for benefits, welfares, and compensations is 1.030.

-

The amounts of public welfare payments to people with children in the districts and localities where regional salary coefficients are to be applied shall be calculated using these coefficients which shall be applied to the above welfare payments in case the regional salary coefficient has not been applied to the salary.

Federal Law No. 463-FZ dated 27 December 2019 «On Amending Article 1 of Federal Law ‘On the Minimum Wage»

Decree No. 61 of the Government of the Russian Federation dated 29 January 2020

MONTHLY CHILDCARE WELFARE FOR CHILDREN UNDER 1.5 Y.O.

Starting 01 June 2020, the priority of children does not matter any more, and the minimum childcare welfare for children under 1.5 y.o. is RUB 6,752 for each child.

Federal Law No. 166-FZ dated 08 June 2020

CHANGE IN MW AND WELFARES

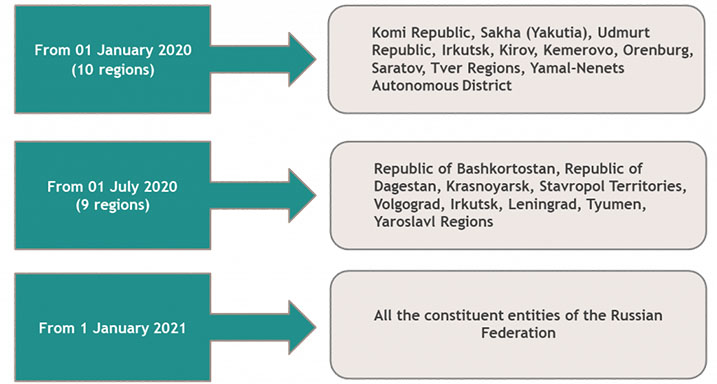

SIF PILOT PROJECT

59 regions involved as of 01 January 2020

CHILD WELFARES SHALL BE TRANSFERRED TO MIR CARDS

Starting 01 May 2019, maternity and delivery welfares, early pregnancy registration welfares, childbirth welfares, and childcare welfares for children under 1.5 y.o. must be transferred to MIR cards, including welfares allocated before 01 May 2019.

If necessary, the childcare welfare that started to be paid before 01 May 2019 can be received to a card of any other payment system until 01 July 2020.

This procedure applies both to regions with the SIF pilot project and for constituent entities with the offset welfare payment mechanism.

Decree No. 419 of the Government of the Russian Federation dated 11 April 2019

Letter No. 02-08-01/16-05-6557l of the Social Insurance Fund dated 05 July 2019

TEMPORARY RULES FOR ISSUING TEMPORARY DISABILITY CERTIFICATES FOR PEOPLE OF 65 Y.O. AND OLDER

Starting 06 April 2020, individuals of 65 y.o. and older who work under employment contracts shall receive temporary disability certificates according to special rules.

To get temporary disability certificates, employers shall send registers with the list of individuals of 65 y.o. and older (born on 06 April 1955 or earlier) and their details to the SIF.

The register shall not include employees of 65 y.o. and holder who are on an annual paid leave or have been transferred to the remote work mode during the aforesaid period.

The sick leave shall not include the periods of:

-

sick leaves for other reasons;

-

annual leaves, unpaid leaves, downtime, and other cases listed in Clause 9 of Federal Law No. 255-FZ.

The period of 06 April to 11 June 2020, for the purpose of issuing temporary disability certificates, is divided into following parts:

-

for 14 calendar days, from 06 to 19 April 2020;

-

for 11 calendar days, from 20 to 30 April 2020;

-

for 18 calendar days, from 12 to 29 May 2020;

-

for 11 calendar days, from 01 to 11 June 2020;

-

from 15 June 2020 until the self-isolation regime is cancelled in a particular constituent entity of the Russian Federation.

Decrees No. 402 dated 01 April 2020; No. 517 dated 16 April 2020; No. 683 dated 15 May 2020; No. 791 dated 30 May 2020; No. 876 dated 18 June 2020 of the Government of the Russian Federation

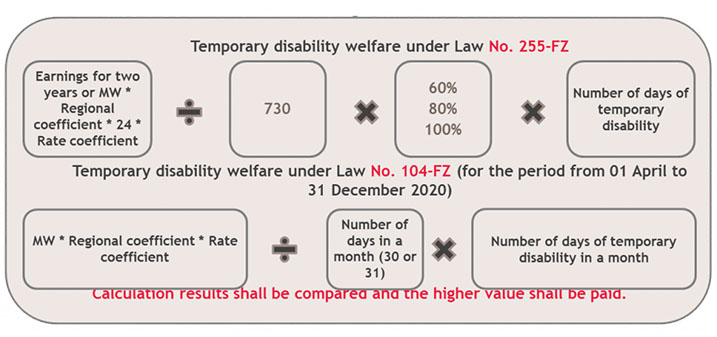

SPECIFIC ASPECTS OF CALCULATING TEMPORARY DISABILITY WELFARE WITH REGARD TO MW

From 01 April 2020 to 31 December 2020, for the purpose of calculating temporary disability welfares in the event of a disease, injury, nursing care, quarantine, prosthetic care, after-treatment, if the amount of welfare calculated under Federal Law No. 255-FZ for a full calendar month is less than MW, the welfare shall be calculated on the basis of MW for each month.

For the cases that started in March and continued in April 2020, payments shall be made as follows:

-

for March – under Law No. 255-FZ;

-

for April – under Law No. 104-FZ.

Federal Law No. 104-FZ dated 01 April 2020

APPLICATION OF A REGIONAL COEFFICIENT TO MW

Starting 19 June 2020, a regional coefficient shall be applied to MW when comparing the actual average earnings and MW, for the purpose of calculating the temporary disability welfare, maternity and delivery welfare, and/or monthly childcare welfare.

Example of calculation:

In January 2020, an employee submitted a temporary disability certificate from 19 June 2020 to 29 June 2020 (10 calendar days)

Earnings for the calculation period: RUB 292,000.00

Pension insurance record: 4 years (60%).

Regional coefficient: 1.2.

-

Actual average daily earnings: RUB 292,000.00/730 = 400.00

-

Average daily earnings from MW: 12,130 * 1.2 * 24/730 = 478.55

-

Higher value 478.55>400.00

-

Average daily welfare, with due regard to the pension insurance record: RUB 478.55 * 60% = RUB 287.13

-

Welfare payable for 10 days: RUB 287.13 * 10 = RUB 2,871.30

Calculation results shall be compared and the higher value shall be paid.

Federal Law No. 175-FZ dated 08 June 2020

Federal Law No. 255-FZ dated 29 December 2006

Federal Law No. 104-FZ dated 01 April 2020

Download the leaflet

- Telegram

- ВКонтакте