Documentation of vehicle usage (including personal) for work-related purposes

- Car rent (including personal)

• With driver

Pursuant to such agreement, the owner undertakes to provide a car to the renter, and render driving and maintenance service (clause 632 of the RCC).

• Without driver

Under such a contract, a company only gets the employee’s car for temporary use (clause 642 of the RCC).

- Remuneration for usage of an employee’s personal car.

Car rent

Pay special attention to the description of the car you’re about to rent. The agreement shall stipulate technical parameters in detail that could suffice while determining which car had been actually rented. Only in such case the rent agreement is considered concluded (as specified in item 3 of clause 607 of the RCC). The rent agreement might also stipulate the conditions for repurchasing the vehicle. The service provision report shall be drawn only if it is provided in the rent agreement. The periodicity of such reports is also stipulated in the contract (every month, every quarter, etc.) In accounting, the cost of the rented car is reflected in the off-balance sheet account per the estimation specified in the contract. There is no amortization for off-balance vehicles.

Taxation

While calculating revenue taxes, expenses related to car rent (including that of an employee) may be accounted for in the amount of actual expenses (sub-item 10 of item 1 of clause 264 and item 1 of clause 252 of the RTC).The organization is entitled to include the following in the expenses:

- POL-related expenses (subcl.2 of item 2 of clause 253 of the RTC);

- insurance payments if insurance is the responsibility of the renter (subcl.1 of item 1 of cl.263 of the RTC, clause 646 of the RCC).

Such a document may be:

- an order of the organization head assigning rented cars to employees;

- applications to use rented cars;

- trip ticket copies that describe frequency of use, routes of rented cars, and time of their usage.

Transport and property taxes for rented vehicles are not payable by the renter (they are paid by the owner). If a company rents an employee’s personal car, the operation is not subject to VAT. The amount of rent is included in the employee’s wages for the purposes of personal income tax payments, however, it is not subject to insurance fees.

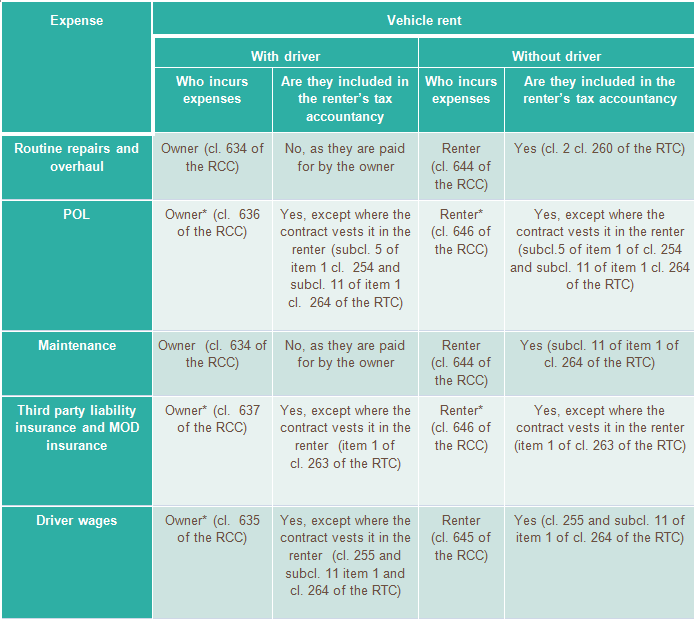

Expenses for rented vehicle operation and their distribution between the parties

* Rent agreement may stipulate other procedures for distribution of said expenses.

Remuneration for usage of an employee’s personal vehicle

A director’s order, or labor/collective agreement stipulating amounts of remuneration are considered the justification for remuneration payment for personal car use. In order to receive the money, the employee has to provide a duly authenticated copy of the personal car’s passport.

Expenses on remuneration for personal car use for work-related purposes may be included in other expenses related to production and sales only within the norms set forth in the Government Decree No.92 d.d. 02.08.2002.

According to the decree, the remuneration norms comprise:

- passenger cars with motor volume under 2,000 cubic cm: 1,200 rubles a month;

- passenger cars with motor volume over 2,000 cubic cm: 1,500 rubles a month.

Thus, regardless of the actual amount paid to the employee for the purposes of remuneration for usage of personal car for work-related purposes, in terms of taxation those expenses are considered only within the norms stipulated by Decree 92.

Tax authorities believe that the employee has to have trip tickets to confirm actual usage of a personal car for work-related trips and feasibility of the incurred expenses. Such confirmation is needed so that the organization could:

- not withhold personal tax and insurance fees from the remuneration sum;

- include the remuneration while calculating income tax.

Furthermore, as the remuneration amounts above include remuneration for car operation (wearing, POL, repairs), the cost of POL remunerated to the employees using their cars for work-related purposes cannot be included in the scope of expenses again (letter of the Ministry of Finance No.03-03-06/1/39239 d.d. 09.23.2013).

POL expenses

Employees (drivers) are usually the ones who actually buy POL at gas stations. The gasoline money are usually provided on condition of accountability.

Within three working days as of the end of term for which the accountable money was provided, the employee must report their expenses (clause 6.3 of the Decree of the Bank of Russia No.3210-U d.d. 03.11.2014). The advance statement shall come together with cash receipts specifying the amount, grade and cost of POL and dates of purchase. In accountancy, the purchased POL are reflected in sub-account 10-3 Fuel.

If the gasoline station has issued an invoice for the organization, or VAT amount is specified in a separate line on the receipt confirming the purchase of POL, VAT may be accepted for deduction. If there is no invoice, POL is entered in the records at the price specified in the receipt (VAT inclusive) as per clause 6 of the PBU 5/01.

The amount of used POL has to be documented, for which purpose trip tickets are required. They may be drawn as per unified or individual form.

Trip tickets

Trip tickets are executed in a single copy for each vehicle. The form shall be filled in by the organization’s employee (say, a secretary or a dispatch controller). All trip tickets shall have numbers and stamps.

When the car leaves and enters the garage, the trip ticket shall be signed or duly stamped by a mechanic or an employee responsible for operation of vehicles. In the former case, they shall also state their full name.

Date and time of pre-trip and post-trip medical examination of drivers are specified by the medical officer who had conducted the examination. Those statements shall be certified with their signature and full name, or duly stamped.

Trip tickets shall be executed for every day or other term no longer than a month. If the vehicle is used by several drivers in shifts, you may execute several trip tickets for the same car (for each driver).

Courts have confirmed that POL expenses do not reduce revenue tax base if trip tickets bear no data on route, mileage, or speedometer data; if the trip tickets were signed by non-authorized persons, or lack full names. Mistakes and minor errors in trip tickets also justify exclusion of said expenses from the list of those reducing revenue tax base.

Usage of company-provided vehicles without trip tickets is considered as personal use by tax authorities. Such revenue, when received in natural form, is included in the PIT base.

POL expenses may be confirmed not just with trip tickets but with any other documents that allow one to determine the route with certainty. For instance, it may be documents filled in on the basis of data from vehicle movement control systems using GLONASS satellite navigation system or other systems. Such clarifications can be found in the letter from the Ministry of Finance No.03-03-06/1/354 d.d. 06.16.2011.